As the demand for rental properties continues to evolve, understanding the trends and demographics within key UK cities is essential for investors. This article delves into the Manchester rental market trends and tenant demographics, with comparative insights from London and Birmingham. The data provided is based on average rents achieved on a rolling 12-month basis compared to the previous 12 months.

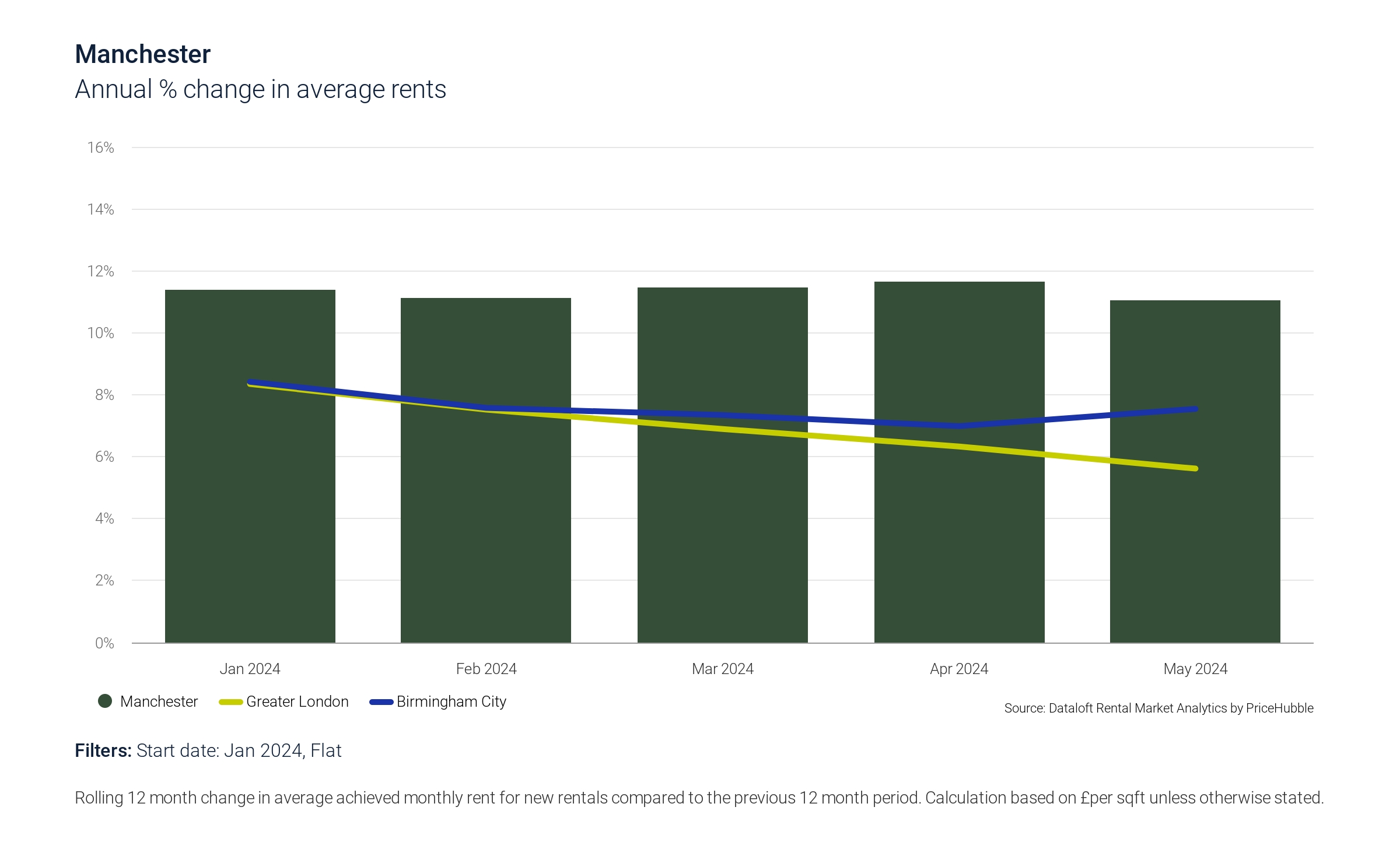

Annual Percentage Change in Average Rents

According to recent data, Manchester exhibits robust growth in rental prices. From January to May 2024, Manchester has consistently maintained an annual percentage change in average rents around 10%. In contrast, Greater London and Birmingham show different trends. London starts the year with a slightly higher percentage than Birmingham but declines more sharply by May. Birmingham, while showing a more modest increase in rents, demonstrates a more stable trend than London. This suggests that Manchester’s rental market is currently more dynamic, offering potentially higher returns for investors.

Homes Let by Rental Band

The distribution of homes let by rental band in Manchester provides valuable insights into the affordability and preference of rental properties. The largest proportion of new rentals falls within the £1000-£1500 range, particularly between £1000-£1250 and £1250-£1500. These bands account for over 60% of the market. The £750-£1000 band is also significant, comprising about 15% of the market.

Comparatively, London has a higher proportion of rentals above £1500, reflecting its higher cost of living. Birmingham shows a similar pattern to Manchester but with a higher concentration in the £750-£1000 range. This indicates that while Manchester remains more affordable than London, it is slightly more expensive than Birmingham, attracting a mid-range tenant demographic.

Profile of Homes Let by Bedroom and Type

The type and size of rental properties in Manchester also vary, catering to diverse tenant needs. The majority of rentals in Manchester are two-bedroom flats, making up 28.2% of the market. This is followed by one-bedroom flats at 16.7% and three-bedroom houses at 12.6%. Notably, 53% of rentals in Manchester are flats, indicating a strong preference for apartment living among tenants.

In comparison, the North West region, including cities like Liverpool, shows a similar pattern but with a slightly higher percentage of three-bedroom houses. This suggests that Manchester’s urban setting drives a higher demand for flats, whereas the broader region accommodates more families seeking larger homes.

Comparative Insights: Manchester Rental Market Trends

Manchester’s rental market stands out for its strong and stable growth in rental prices, reflecting a healthy demand. The city’s rental band distribution indicates a balanced market with a slight tilt towards mid-range properties, making it an attractive option for both investors and tenants. The preference for flats, especially two-bedroom units, aligns with urban living trends, attracting young professionals and small families.

London’s higher rental prices and greater proportion of high-end rentals highlight its premium market status, which may deter cost-sensitive tenants. Birmingham, on the other hand, offers more affordability but with less pronounced rental growth compared to Manchester.

Conclusion: Manchester Rental Market

Manchester’s rental market presents a compelling opportunity for investors, characterized by steady rental growth, a balanced rental band distribution, and a strong preference for flats. Compared to London and Birmingham, Manchester offers a middle ground with robust demand and affordability, making it a promising destination for property investment. As the city continues to develop and attract a diverse tenant base, investors can expect sustained interest and healthy returns in the Manchester rental market.

The rental data provided in this analysis is based on average rents achieved on a rolling 12-month basis compared to the previous 12 months, ensuring a comprehensive and up-to-date understanding of market trends. To keep informed of latest market updates please visit or call Colm on +65 84688303