The private rental sector now accommodates 20% of all UK households, with the figure rising to 30% in London, and continues to expand annually. As more people opt for longer stays in rental homes, the variety of job roles among tenants has also grown. Here we discuss UK Tenant demographics and how they impact the UK Rental market.

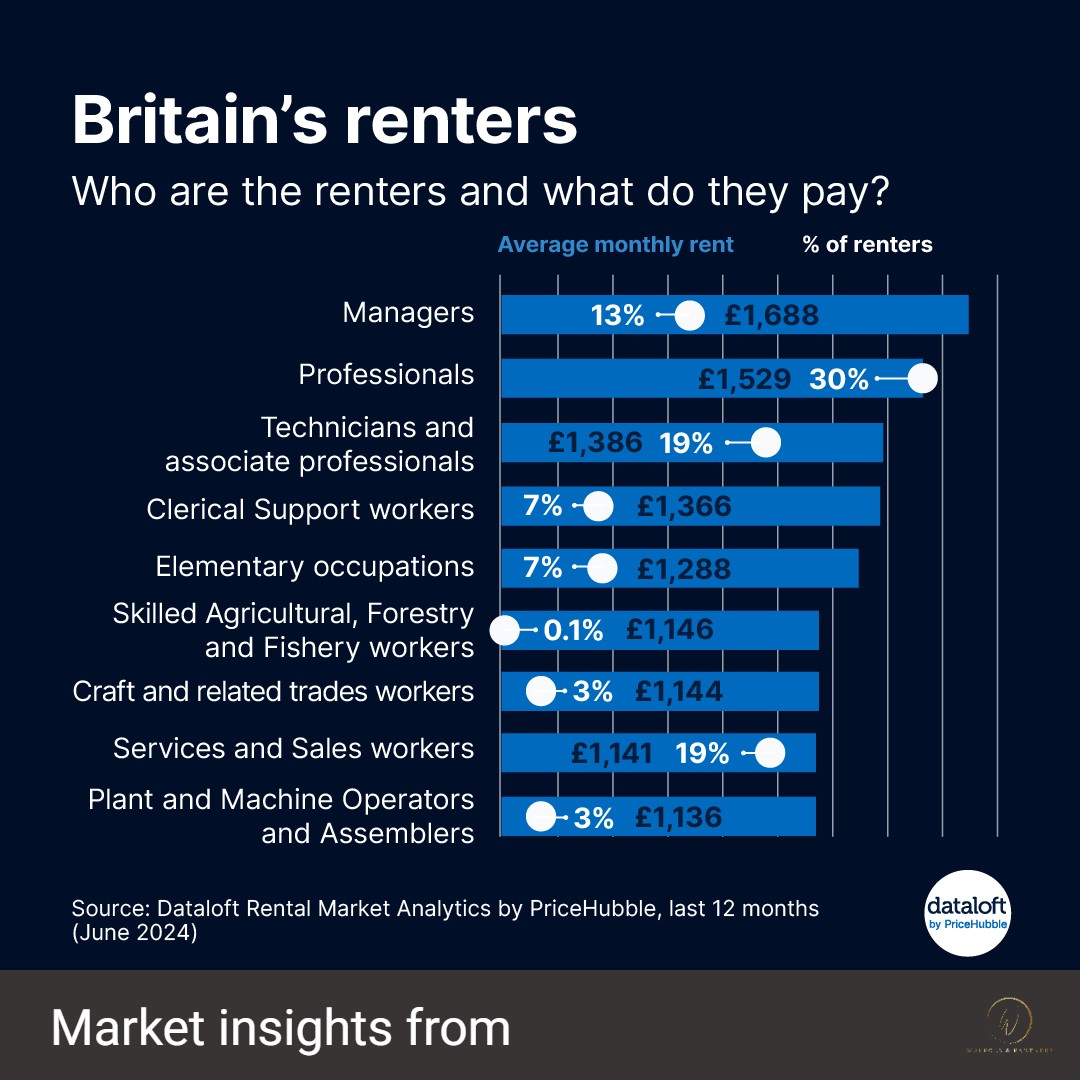

Job Roles and Earnings

- Professional Jobs: 30% of private sector renters hold professional positions, such as scientists, health workers, teachers, business professionals, tech experts, and legal practitioners. These tenants pay an average monthly rent of £1,529 and earn around £46,000 annually.

- Managers and Chief Executives: Renters in managerial roles or as chief executives pay the highest average monthly rents, at £1,688, and have the highest average annual earnings of £57,000.

- Service and Sales Workers: There has been a notable increase in renters working in service and sales roles, rising from 14% in 2020 to 19%. This category includes retail, hospitality, and other service roles, which were significantly impacted during the pandemic.

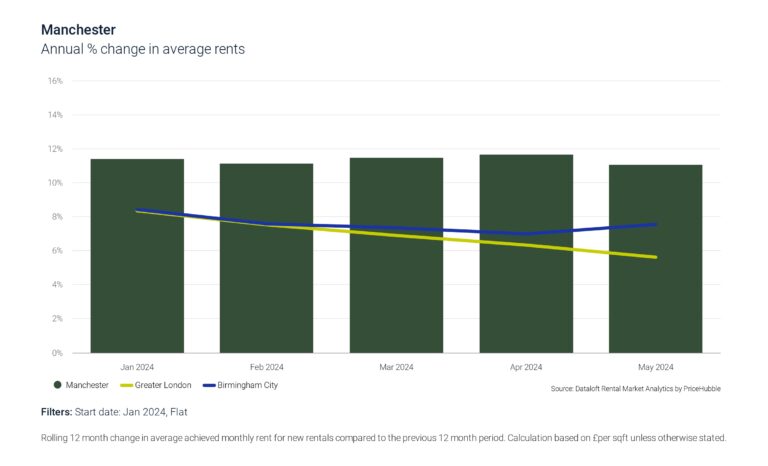

Wage Growth vs. Rental Appreciation

- London: Rental appreciation in London has outpaced wage growth, leading to higher rent-to-income ratios and reducing disposable income for renters. Percentage of Income Paid on Rent: Approximately 40%

- Manchester: Wage growth has been more aligned with rental appreciation, offering a more balanced cost of living for renters. Percentage of Income Paid on Rent: Approximately 30%

- Birmingham: Similar to Manchester, Birmingham has seen wage growth that keeps pace with rental increases, ensuring renters retain a reasonable amount of disposable income. Percentage of Income Paid on Rent: Approximately 30%

Disposable Income by City

Among the cities analyzed, Manchester emerges as the city where workers have the most disposable income. This is due to a more favorable balance between wage growth and rental costs, making it an attractive option for renters seeking better affordability.

Impact of the Cost of Living Crisis-UK Rental Market Demographics

The cost of living crisis in 2023 has exacerbated concerns about rent affordability, particularly in London where the percentage of income paid on rent is the highest. The lack of rental supply has driven rental inflation, placing additional financial strain on renters (Office for National Statistics) (Office for National Statistics).

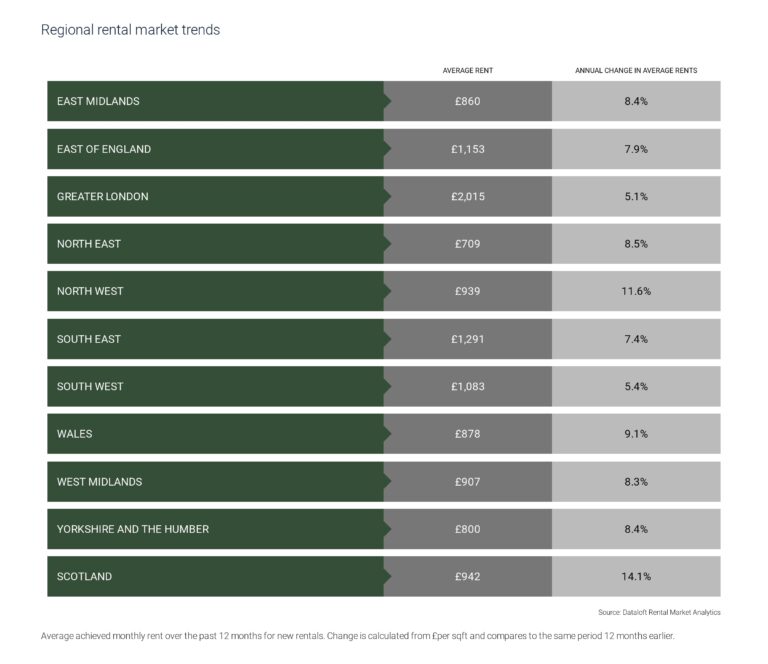

Rental Inflation and Expectations for 2024

Rental inflation has been a significant concern in 2023, but a moderate growth in rental prices is expected in 2024. This moderate growth is not necessarily negative for the following reasons:

- Stabilization of the Market: After a period of high inflation, moderate growth indicates a stabilizing rental market.

- Predictability for Investors and Renters: More predictable rent increases help both investors plan their investments better and renters manage their budgets.

- Sustainable Growth: Moderate rental growth is more sustainable in the long term, reducing the risk of market bubbles and ensuring a healthier housing market overall (Office for National Statistics).

Student Rental Accommodation

Each year, the UK welcomes approximately 500,000 international students who require rental accommodation, significantly contributing to the demand for rental properties, particularly in university cities. The peak season for students traveling to the UK to study is from August to October, when demand for rental accommodation is greatest (Office for National Statistics).

Conclusion

With a general election on the horizon, monitoring these trends is crucial to adapting to the evolving rental market in Britain. Understanding the diverse job demographics, pay ranges among UK tenants, the impact of the cost of living crisis, and the alignment of wage growth with rental appreciation helps in making informed decisions for property investments. The expected moderate rental growth in 2024 provides a more stable and predictable environment for both investors and renters. Here we have provided a regional breakdown on rental.